ซื้อหวยออนไลน์เว็บไหนดี 10 เว็บแทงหวย888 เชื่อถือได้ จ่ายจริง 2568

การซื้อหวยออนไลน์กลายเป็นอีกหนึ่งทางเลือกยอดนิยมของคนไทยที่ชื่นชอบการเสี่ยงโชค แต่หลายคนอาจยังสงสัยว่า ควรเลือกซื้อหวยออนไลน์เว็บไหนดี ที่ทั้งปลอดภัย เชื่อถือได้ และให้ผลตอบแทนคุ้มค่า โดยเฉพาะหวยยอดฮิตอย่าง หวยลาว หวยฮานอย หวยหุ้น หรือหวยยี่กีบทความนี้จะพาคุณไปรู้จักกับ 10 เว็บหวยออนไลน์ชั้นนำที่ได้รับความนิยมสูงสุดในปัจจุบัน แต่ละเว็บมีจุดเด่นที่แตกต่าง ไม่ว่าจะเป็นอัตราจ่ายที่สูงถึงบาทละ 1,000 การให้บริการหวยหลากหลายประเภททั้งไทยและต่างประเทศ เช่น หวยรัฐบาล หวยออมสิน หวยธ.ก.ส. หวยลาว หวยฮานอย หวยมาเลย์ หวยหุ้น และหวยยี่กีที่ออกรางวัลหลายรอบต่อวันนอกจากนี้ บางเว็บยังเน้นระบบฝาก-ถอนที่รวดเร็ว มีขั้นต่ำในการใช้งานที่เข้าถึงง่าย และมาพร้อมโปรโมชั่นที่ดึงดูดใจ ตอบโจทย์ทั้งคอหวยมือใหม่และนักเสี่ยงโชคประจำที่มองหาความสะดวกและความคุ้มค่าในการแทงหวยออนไลน์อย่างแท้จริง

ซื้อหวย365

- หวยชุดที่มีอัตราจ่ายสูงสุด 120,000 บาท

- ระบบแนะนำเพื่อนรับค่าคอมมิชชั่นสูงสุด 8%

- เริ่มฝากเงินขั้นต่ำเพียง 20 บาท

Lottofree.Center

- ระบบทันสมัย ฝากถอนไวใน 30 วินาที

- มีหวยให้เลือกเล่นครบวงจร จ่ายจริง

- รองรับการใช้งานผ่านมือถือทุกระบบ

Huaysod

- มีหวยลาวชุด อัตราจ่ายสูงสุด 90,000 บาท ให้เลือกซื้อ

- มีหวยฮานอยให้เลือกซื้อหลากหลายประเภท

- มีอัตราจ่ายสูงสุดของหวยออนไลน์ 950 บาท

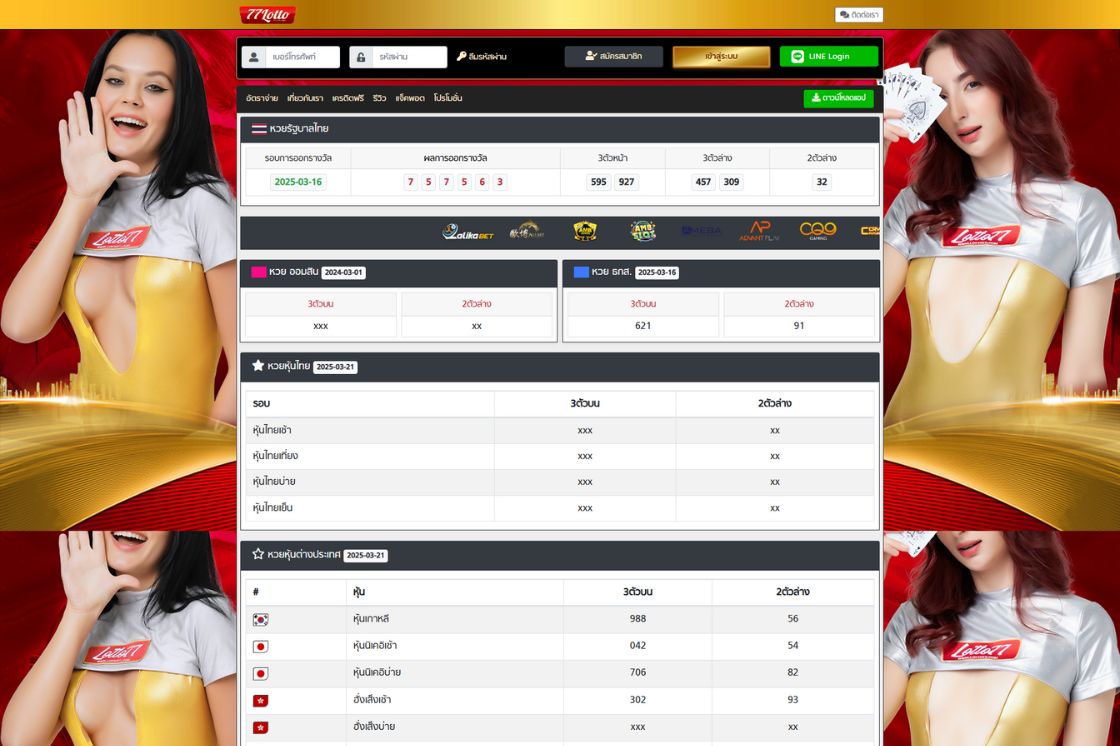

77Lotto

- ไม่มีการกำหนดขั้นต่ำในการฝากเงิน เริ่มฝากได้ตั้งแต่ 1 บาทขึ้นไป

- ระบบแนะนำเพื่อนรับค่าคอมมิชชั่นสูงสุด 8%

- มีทั้งหวยออนไลน์และเกมเดิมพันคาสิโนออนไลน์ให้เลือกเล่น

Confirm168

- อัตราจ่ายของหวยออนไลน์สูงสุด 1,000 บาท

- เริ่มซื้อหวยออนไลน์ได้ง่าย เริ่มฝากขั้นต่ำเพียง 50 บาท

- สามารถเลือกซื้อหวยออนไลน์และเล่นเกมเดิมพัน

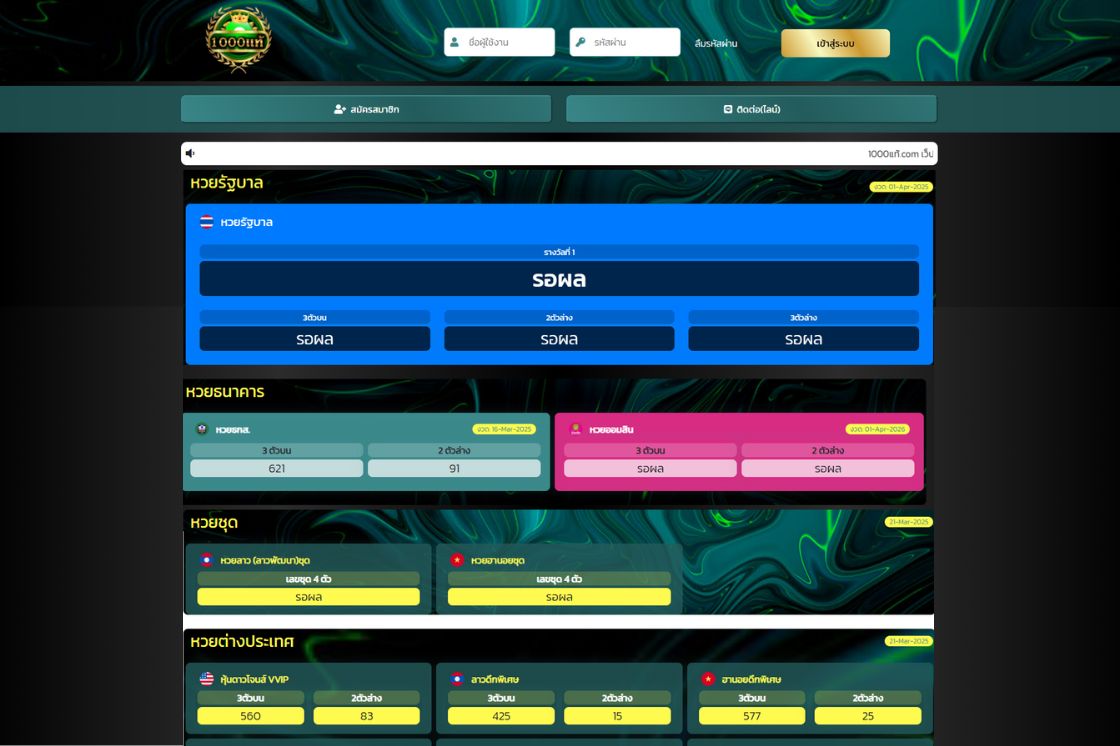

1000แท้

- อัตราจ่ายของหวยออนไลน์สูงสุด 4,000 บาท สำหรับ 4 ตัวบน

- อัตราจ่ายของหวยออนไลน์สูงสุด 1,000 บาท สำหรับ 3 ตัวบน

- เริ่มซื้อหวยออนไลน์ได้ง่าย เริ่มฝากขั้นต่ำเพียง 50 บาท

Tong998

- อัตราจ่ายของหวยออนไลน์สูงสุด 1,000 บาท สำหรับ 3 ตัวบน

- มีหวยฮานอยให้เลือกซื้อ 11 ประเภท หวยลาว 14 ประเภท

- มีทั้งหวยออนไลน์และเกมเดิมพันคาสิโนออนไลน์ให้เลือกเล่น

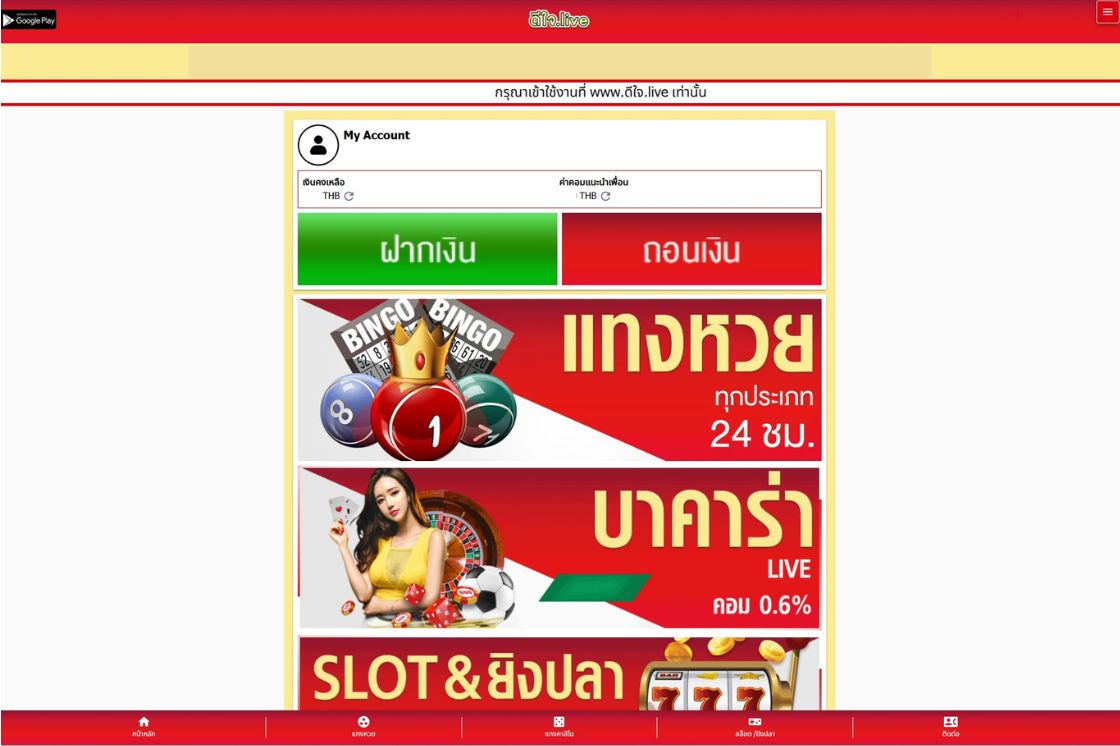

ใจดี24

- อัตราจ่ายของหวยออนไลน์สูงสุด 4,000 บาท สำหรับ 4 ตัวบน

- อัตราจ่ายของหวยออนไลน์สูงสุด 1,000 บาท สำหรับ 3 ตัวบน

- เริ่มซื้อหวยออนไลน์ได้ง่าย เริ่มฝากขั้นต่ำเพียง 50 บาท

Lottoone

- หวยชุด มีโอกาสรับรางวัลสูงถึง 120,000 บาท

- วงล้อมหาสนุกมีรางวัลสูงสุดถึง 10,000 บาท

- มีโปรโมชั่นโบนัสประจำวันให้กับสมาชิก

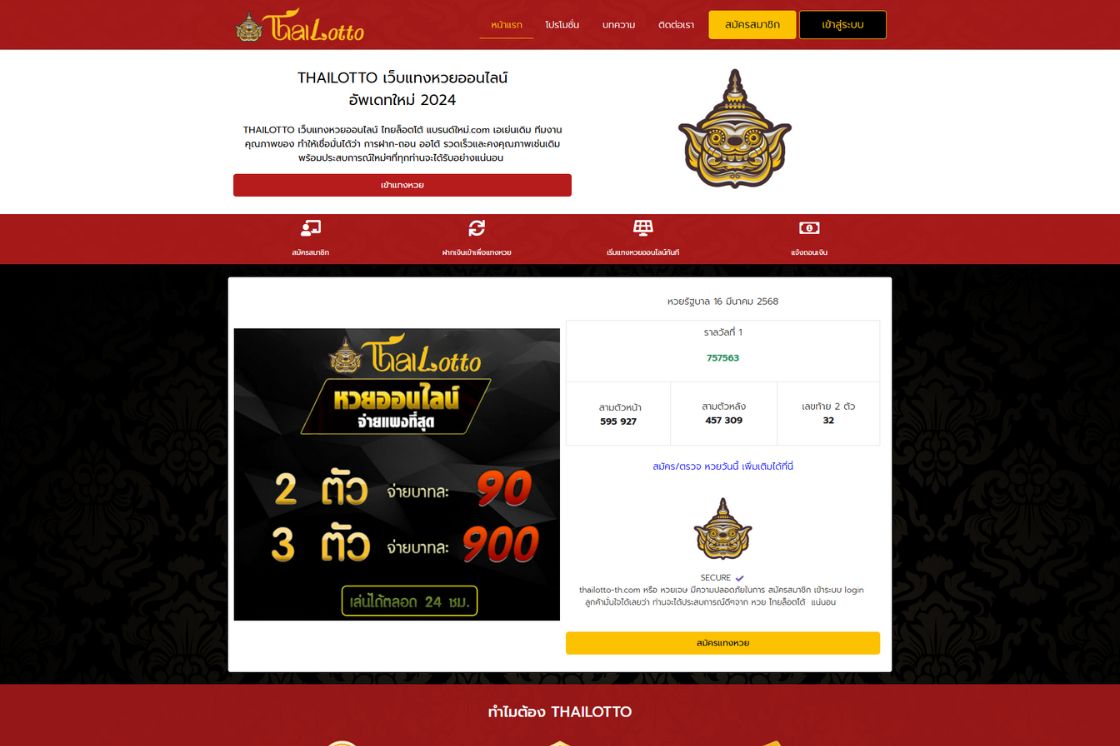

Thailotto

- หวยลาวชุดที่มีอัตราจ่ายสูงถึง 120,000 บาท

- หวยแจ๊คพอตที่ลุ้นรับเงินรางวัลสูงถึง 400,000 บาท

- วงล้อนำโชคที่มีเงินรางวัลสูงสุด 100,000 บาท

10 เว็บซื้อหวยออนไลน์ จ่ายจริง เชื่อถือได้

ต่อไปนี้เป็น 10 อันดับเว็บแทงหวยออนไลน์ยอดนิยมประจำปี 2568

- ซื้อหวย365

- Lottofree.Center

- Huaysod

- 77Lotto

- Confirm168

- 1000แท้

- Tong998

- ใจดี24

- Lottoone

- Thailotto

1. ซื้อหวย365

ซื้อหวย365 เป็นเว็บหวยออนไลน์ที่ให้บริการหวยครบวงจร โดดเด่นด้วยความหลากหลายของหวย ทั้ง หวยไทย อย่างหวยรัฐบาล หวยออมสิน หวย ธ.ก.ส. หวยต่างประเทศ อย่างหวยฮานอย หวยลาว หวยมาเลย์ หวยชุด และ หวยหุ้น จากหลายประเทศ รวมถึงหวยยี่กี VIP ที่เปิดให้เล่น 88 รอบต่อวัน พร้อมอัตราจ่ายที่สูงถึง 900 บาท สำหรับ 3 ตัวบน และหวยชุดที่จ่ายสูงสุดถึง 120,000 บาท นอกจากนี้ยังมีระบบฝาก-ถอนที่รวดเร็วและปลอดภัย โดยฝากขั้นต่ำเพียง 20 บาท ถอนขั้นต่ำ 100 บาท และมีระบบ AF ที่ให้ส่วนแบ่งสูงถึง 8% สำหรับหวยต่างประเทศ ยังมีเกมเดิมพันครบวงจรจากค่ายชั้นนำมากมาย

| ข้อดี | ข้อเสีย |

|---|---|

| มีหวยให้เลือกหลากหลาย รวมถึงหวยชุด | ถอนขั้นต่ำค่อนข้างสูงสำหรับบางผู้เล่น (100 บาท) |

| ระบบฝาก-ถอนรวดเร็ว | ไม่มีแอปพลิเคชันสำหรับมือถือ |

2. Lottofree.Center

Lottofree.Center คือเว็บหวยออนไลน์ที่กำลังมาแรงในปี 2568 ด้วยระบบที่ทันสมัยและเสถียรที่สุด รองรับการแทงหวยทุกรูปแบบ ไม่ว่าจะเป็นหวยรัฐบาลไทย หวยฮานอย หวยลาว หรือหวยหุ้นต่างประเทศ จุดเด่นอยู่ที่ระบบฝาก-ถอนอัตโนมัติที่รวดเร็วภายใน 30 วินาที และไม่มีขั้นต่ำในการฝาก ทำให้ผู้เล่นทุนน้อยก็สามารถร่วมสนุกได้ นอกจากนี้ยังมีทีมงานคอยดูแลตลอด 24 ชั่วโมง มั่นใจได้เรื่องความปลอดภัยและการเงินที่มั่นคง จ่ายจริง ไม่มีการโกงแน่นอน

| ข้อดี | ข้อเสีย |

|---|---|

| ระบบทันสมัย ฝาก-ถอน รวดเร็ว | เว็บใหม่ อาจยังไม่มีรีวิวมากนัก |

| ไม่มีขั้นต่ำในการฝาก | ไม่มีโบนัสสำหรับสมาชิกเก่า |

4. Huaysod

Huaysod เป็นเว็บหวยออนไลน์ยอดนิยมที่โดดเด่นด้วยอัตราจ่ายสูงถึง 950 บาท สำหรับ 3 ตัวบน และมีหวยให้เลือกซื้อหลากหลายประเภท ทั้ง หวยในประเทศ อย่างหวยรัฐบาล หวยออมสิน หวยธกส. หวยต่างประเทศ ที่มีให้เลือกซื้อมากมาย เช่น หวยฮานอย 10 ประเภท หวยลาว 8 ประเภท รวมถึง หวยชุด อย่างหวยฮานอยชุดและหวยลาวชุดที่มีอัตราจ่ายสูงถึง 90,000 บาท สำหรับ 4 ตัวตรง และ หวยหุ้นต่างประเทศ ทั้งแบบปกติและ VIP ที่ครอบคลุมตลาดหุ้นทั่วโลก ระบบเว็บได้มาตรฐาน ใช้งานง่าย รองรับทุกอุปกรณ์ พร้อมระบบออกผลรางวัลที่แม่นยำและรวดเร็ว การสมัครสมาชิกทำได้ง่ายเพียง 4 ขั้นตอนด้วยการยืนยัน OTP ผ่านโทรศัพท์มือถือ นอกจากนี้ยังมีระบบพันธมิตร (Affiliate) ที่ให้ค่าคอมมิชชั่นแก่ผู้ชักชวนลูกค้าใหม่

| ข้อดี | ข้อเสีย |

|---|---|

| รองรับหวยหลายประเทศและหวยชุด | ถอนขั้นต่ำ 300 บาท อาจสูงสำหรับผู้เริ่มต้น |

| ระบบออกผลแม่นยำ รวดเร็ว | ไม่มีแอปพลิเคชันบนมือถือ |

4. 77Lotto

Lotto77 เป็นเว็บหวยออนไลน์ที่เปิดให้บริการมายาวนาน โดดเด่นด้วยความหลากหลายของหวยที่ให้บริการ ทั้ง หวยไทย อย่างหวยรัฐบาล หวยออมสิน หวยธกส. หวยต่างประเทศ ทั้งหวยฮานอย หวยลาว หวยมาเลย์ หวยจับยี่กี หวยหุ้น จากหลายประเทศ และ หวยชุด จากหลายประเภท พร้อมให้บริการเกมเดิมพันอีกมากมายจากค่ายชั้นนำ ทั้งเกมคาสิโน เกมสล็อต เกมยิงปลา และพนันกีฬา มีอัตราจ่ายสูงถึง 900 บาท สำหรับหวยรัฐบาลไทย 3 ตัวบน และ 850 บาท สำหรับหวยต่างประเทศ ระบบฝากถอนรวดเร็วภายใน 1-3 นาที ฝากขั้นต่ำเพียง 1 บาท ถอนขั้นต่ำ 300 บาท มีโปรโมชั่นและกิจกรรมหลากหลาย เช่น กงล้อนำโชค เปิดไพ่นำโชค ระบบ Ranking VIP และยังมีระบบแนะนำเพื่อนที่ให้ส่วนแบ่ง 8% จากยอดซื้อหวยของผู้ที่ถูกแนะนำมา

| ข้อดี | ข้อเสีย |

|---|---|

| ฝากขั้นต่ำเพียง 1 บาท | ถอนขั้นต่ำค่อนข้างสูง (300 บาท) |

| มีเกมคาสิโนและกิจกรรมเสริม | อัตราจ่ายบางหวยต่ำกว่าเว็บอื่น |

5. Confirm168

Confirm168 เป็นแพลตฟอร์มออนไลน์ที่ให้บริการด้านหวยและเกมพนันหลากหลายประเภท โดดเด่นด้วยการให้บริการหวยที่ได้รับความนิยม ทั้ง หวยไทย ที่มีอัตราจ่ายสูงถึง 1,000 บาท สำหรับ 3 ตัวบน และ หวยฮานอย ที่มีให้เลือกหลากหลายประเภท อาทิ หวยฮานอย VIP หวยฮานอยเช้า หวยฮานอยรอบดึก รวมถึง หวยลาว ที่มีบริการมากถึง 14 ประเภท ทั้งหมดมีอัตราจ่ายที่เท่าเทียมกันคือ 3 ตัวบน จ่าย 1,000 บาท และ 2 ตัวบน/ล่าง จ่าย 100 บาท นอกจากนี้ยังมีระบบฝาก-ถอนที่เป็นมิตรกับผู้เล่น โดยฝากขั้นต่ำเพียง 50 บาท และถอนขั้นต่ำ 300 บาท พร้อมบริการเกมเสริมอื่นๆ ทั้งคาสิโนสด สล็อต เกมการ์ด เกมยิงปลา และมินิเกม ทำให้ผู้เล่นสามารถเพลิดเพลินกับเกมพนันได้หลากหลายรูปแบบในที่เดียว

| ข้อดี | ข้อเสีย |

|---|---|

| จ่ายสูงถึงบาทละ 1,000 บาท | ถอนขั้นต่ำ 300 บาท |

| หวยลาว-ฮานอยมีหลายประเภท | ไม่มีแอปเฉพาะใช้งานบนมือถือ |

6. 1000แท้

1000แท้ เป็นแพลตฟอร์มหวยออนไลน์ที่ได้รับความนิยมด้วยจุดเด่นด้านอัตราจ่ายที่สูง โดยเฉพาะ 3 ตัวบน ที่จ่ายบาทละ 1,000 บาท และ 4 ตัวบน ที่จ่ายสูงถึง 4,000 บาท พร้อมให้บริการหวยหลากหลายประเภท ทั้ง หวยไทย ที่มีรูปแบบการแทงครบครัน หวยต่างประเทศ อย่างหวยลาว หวยฮานอย หวยมาเลย์ ที่มีอัตราจ่ายใกล้เคียงกัน รวมถึง หวยหุ้น และ หวยยี่กี ที่ออกรางวัลบ่อยครั้ง มีระบบฝาก-ถอนที่เข้าถึงง่าย โดยกำหนดยอดฝากขั้นต่ำเพียง 50 บาท และถอนขั้นต่ำ 200 บาท เหมาะสำหรับนักเสี่ยงโชคทุกระดับ ที่สามารถเลือกเล่นได้หลากหลายรูปแบบ ทั้งเลขตรง เลขโต๊ด เลขวิ่ง และเลขปัก ตามความถนัดของแต่ละคน

| ข้อดี | ข้อเสีย |

|---|---|

| อัตราจ่ายสูงกว่าหลายเว็บ โดยเฉพาะ 4 ตัวบน | ไม่มีระบบแชทสดช่วยเหลือทันที |

| รองรับหวยยี่กีออกถี่ เหมาะกับคนชอบเล่นถี่ | ไม่มีโปรโมชั่นดึงดูดสำหรับผู้เล่นใหม่ |

7. Tong998

Tong998 เป็นแพลตฟอร์มหวยออนไลน์ครบวงจรที่ให้บริการหลากหลายประเภท ทั้ง หวยไทย ที่มีอัตราจ่ายสูงถึง 1,000 บาท ต่อบาทสำหรับ 3 ตัวบน พร้อมอัตราจ่ายที่น่าสนใจสำหรับรูปแบบการแทงอื่นๆ หวยฮานอย ที่มีให้เลือกถึง 11 ประเภท และ หวยลาว ที่มีให้บริการมากถึง 14 ประเภท ทำให้ผู้เล่นสามารถเสี่ยงโชคได้แทบทุกวัน นอกจากนี้ยังมี หวยหุ้น และ หวยยี่กี ที่มีรอบออกรางวัลถี่มาก โดยเฉพาะจับยี่กีห้านาทีที่มีการออกรางวัลถึง 264 รอบต่อวัน ทุกประเภทหวยมีอัตราจ่ายมาตรฐานเท่ากัน คือ 3 ตัวบนจ่าย 1,000 บาท และ 2 ตัวบน/ล่างจ่าย 100 บาท พร้อมเงื่อนไขการฝากถอนที่เข้าถึงง่าย ฝากขั้นต่ำเพียง 50 บาท และถอนขั้นต่ำ 300 บาท รวมทั้งยังมีเกมเพิ่มเติมที่หลากหลาย เช่น คาสิโนสด สล็อต เกมการ์ด เกมยิงปลา และมินิเกม

| ข้อดี | ข้อเสีย |

|---|---|

| รองรับหวยยี่กี 264 รอบต่อวัน | ถอนขั้นต่ำเริ่มต้นที่ 300 บาท |

| มีเกมพนันเสริมให้เลือกเล่นครบ | เว็บไซต์ดีไซน์เรียบ ไม่หวือหวา |

8. ใจดี24

ใจดี24 เป็นผู้ให้บริการหวยออนไลน์ยอดนิยมที่โดดเด่นด้วยอัตราจ่ายสูงเป็นพิเศษ โดยเฉพาะสำหรับ 3 ตัวบน ที่จ่ายถึงบาทละ 1,000 บาท และ 4 ตัวบน ที่จ่ายสูงถึง 4,000 บาท มีบริการหวยหลากหลายประเภท ทั้ง หวยไทย ที่เป็นที่นิยม หวยต่างประเทศ อย่างหวยลาว หวยฮานอย หวยมาเลย์ ที่มีอัตราจ่ายเท่ากันที่ 1,000 บาท สำหรับ 3 ตัวบน รวมถึง หวยหุ้น และ หวยยี่กี ที่ออกรางวัลบ่อยครั้ง มีรูปแบบการแทงหลากหลายทั้งแทงเลขตรง เลขโต๊ด เลขวิ่ง และเลขปัก พร้อมระบบฝากถอนที่เข้าถึงง่ายด้วยยอดฝากขั้นต่ำเพียง 50 บาท และถอนขั้นต่ำ 200 บาท ทำให้นักเสี่ยงโชคทุกระดับสามารถเข้าถึงบริการได้

| ข้อดี | ข้อเสีย |

|---|---|

| อัตราจ่ายสูงสุดถึงบาทละ 1,000 และ 4,000 | ไม่มีระบบสมาชิก VIP หรือสะสมแต้ม |

| แทงเลขได้หลายแบบ ทั้งตรง โต๊ด วิ่ง ปัก | ไม่รองรับการสมัครผ่านโซเชียลมีเดีย |

9. Lottoone

Lottoone เป็นแพลตฟอร์มหวยออนไลน์ชั้นนำที่โดดเด่นด้วยความหลากหลายของประเภทหวยที่ให้บริการ ทั้ง หวยรัฐบาล ที่มีอัตราจ่ายสูงถึง 950 บาท สำหรับ 3 ตัวบน หวยต่างประเทศ อย่างหวยลาว หวยฮานอย และหวยมาเลย์ ที่มีอัตราจ่ายสูงถึง 900 บาท รวมถึง หวยยี่กี ที่มีหลากหลายรูปแบบทั้งแบบ 88 รอบ และแบบ 5 นาที (264 รอบต่อวัน) จากหลายแบรนด์ เช่น ยี่กี Huay, ยี่กี LTO และยี่กี ชัดเจน นอกจากนี้ยังมี หวยเลขชุด ที่มีโอกาสรับรางวัลสูงถึง 120,000 บาท พร้อมระบบการทำธุรกรรมที่เป็นมิตรกับผู้ใช้ โดยกำหนดยอดฝากขั้นต่ำที่ 100 บาท และถอนขั้นต่ำ 200 บาท มีโปรโมชั่นโบนัสประจำวันและวงล้อมหาสนุกที่มีรางวัลสูงสุดถึง 10,000 บาท ช่วยเพิ่มความตื่นเต้นในการเล่น

| ข้อดี | ข้อเสีย |

|---|---|

| มีระบบหวยยี่กีหลายแบรนด์ในที่เดียว | ฝากขั้นต่ำค่อนข้างสูง (100 บาท) |

| มีวงล้อมหาสนุกแจกโบนัสทุกวัน | ไม่มีระบบ Affiliate แนะนำเพื่อน |

10. Thailotto

Thailotto เป็นเว็บหวยออนไลน์ยอดนิยมที่ให้บริการหวยหลากหลายประเภท ทั้ง หวยไทย อย่างหวยรัฐบาล หวยธกส หวยออมสิน หวยหุ้นไทย หวยต่างประเทศ ทั้งหวยมาเลย์ หวยลาว หวยฮานอย และ หวยหุ้นต่างประเทศ มากกว่า 12 ประเภท รวมถึง หวยลาวชุด โดยมีอัตราจ่ายสูงสุดสำหรับหวยรัฐบาลไทยและหวยต่างประเทศที่ 800 บาท และหวยลาวชุดที่จ่ายสูงถึง 120,000 บาท มีระบบการสมัครสมาชิกที่ง่ายดายเพียง 5 ขั้นตอน พร้อมโปรโมชั่นสำหรับสมาชิกใหม่ที่ฝากเงินครั้งแรก โดยได้รับโบนัสสูงสุดถึง 100% นอกจากนี้ยังมีกิจกรรมพิเศษอย่างหวยแจ๊คพอตที่ลุ้นรับเงินรางวัลสูงถึง 400,000 บาท และวงล้อนำโชคที่มีเงินรางวัลสูงสุด 100,000 บาท ระบบฝาก-ถอนเข้าถึงง่ายด้วยการฝากขั้นต่ำเพียง 50 บาท ถอนขั้นต่ำ 500 บาท และมีระบบแนะนำเพื่อนที่ให้ส่วนแบ่งค่าแนะนำสูงสุดถึง 8%

| ข้อดี | ข้อเสีย |

|---|---|

| มีหวยแจ็คพอตและกิจกรรมแจกเงินสด | อัตราจ่ายหวยรัฐบาลต่ำกว่าเว็บอื่นเล็กน้อย |

| ระบบสมัครง่ายและมีโบนัสสมาชิกใหม่ | ถอนขั้นต่ำสูง (500 บาท) |

รูปแบบการซื้อของหวยออนไลน์

หวยออนไลน์ถือเป็นหนึ่งในการเสี่ยงโชคได้รับความนิยมอย่างมากในปัจจุบัน ทำให้มีผู้เล่นมือใหม่หรือผู้ที่เคยซื้อหวยใต้ดินมาก่อน หันมาเลือกซื้อหวยออนไลน์กันมากขั้น โดยจะมีจุดเด่นทั้งในเรื่องของอัตราจ่ายที่สูง ความสะดวกในการซื้อ เนื่องจากมรีหวยออนไลน์ให้เลือกซื้อหลากหลายประเภท ดังนั้นผู้เล่นก็ควรที่จะหาข้อมูลเกี่ยวกับหวยออนไลน์ประเภทนั้นให้ดีก่อนทำการเสี่ยงโชค โดยรูปแบบการซื้อของหวยออนไลน์แต่ละประเภทนั้นก็จะมีความคล้ายกัน หวยออนไลน์ส่วนใหญ่จะมีรูปแบบการซื้อดังนี้

- 3 ตัวบน

- 3 ตัวโต๊ด

- 2 ตัวบน

- 2 ตัวล่าง

- วิ่งบน

- วิ่งล่าง

นอกจากนั้นจะยังมีในส่วนของหวยชุด ที่จะมีรูปแบบการซื้อที่คล้ายกันกับการซื้อสลากกินแบ่งรัฐบาล เช่น หวยลาวชุด หวยฮานอยชุด หวยมาเลย์ชุด หวยรัฐบาลชุด ซึ่งจะขึ้นอยู่กับเว็บหวยออนไลน์ที่เลือกซื้อด้วยว่ามีหวยชุดประเภทใดให้เลือกซื้อ

หวยออนไลน์แต่ละประเภทที่มีให้เลือกซื้อ

เว็บหวยออนไลน์ส่วนใหญ่นั้น มักจะมีหวยออนไลน์ให้เลือกซื้อหลากหลายประเภท ซึ่งแต่ละเว็บนั้นก็จะมีให้เลือกซื้อแตกต่างกันออกไป บางเว็บก็อาจจะมีประเภทหวยออนไลน์พื้นฐานที่เว็บส่วนใหญ่มี แต่บางเว็บก็จะมีประเภทของหวยออนไลน์อื่นๆ ให้เลือกซื้อด้วยเช่นกัน เว็บหวยออนไลน์ส่วนใหญ่มันจะแยกหมวดหมู่ของหวยออนไลน์ดังนี้

- หวยไทย

หวยรัฐบาล, หวยออมสิน, หวยธกส. - หวยต่างประเทศ

หวยฮานอย, หวยลาว, หวยมาเลย์ - หวยหุ้น / หวยหุ้น VIP

หวยหุ้นจีน, หวยหุ้นนิเคอิ, หวยหุ้นฮั่งเส็ง, หวยหุ้นเกาหลี, หวยหุ้นสิงคโปร์, หวยหุ้นเยอรมัน, หวยหุ้นอินเดีย, หวยหุ้นอังกฤษ, หวยหุ้นอียิปต์, หวยหุ้นไต้หวัน - 2 ตัวล่าง

- หวยยี่กี

หวยยี่กี (88 รอบ), หวยยี่กี (264 รอบ)

สำหรับหวยออนไลน์ประเภทอื่นๆ หรือหวยแปลกๆที่มีให้เลือกซื้อ ส่วนใหญ่แล้วจะเป็น หวยลาวและหวยฮานอย เช่น หวยลาวร่วมใจ, หวยลาววิลล่า, หวยลาวนคร, หวยลาวจำปา, หวยฮานอยท้องถิ่น, หวยฮานอยเดย์, หวยฮานอย (Extra) ซึ่งจะเป็นหวยที่มีให้เลือกซื้อหลากหลายประเภทมากๆ

สิ่งที่มีให้เลือกเล่นนอกจากหวยออนไลน์

นอกจากจะมีหวยออนไลน์ให้เลือกซื้อแล้ว เว็บหวยออนไลน์ส่วนใหญ่มักจะมีเกมเดิมพันอื่นๆ ให้ผู้เล่นได้เลือกเสี่ยงโชคได้ด้วย โดยเว็บหวยออนไลน์หลายๆเว็บ มักจะมีเกมเดิมพันให้ผู้เล่นนั้นได้เลือกเสี่ยงโชคกันได้เพิ่มด้วย ซึ่งหลักแล้วเว็บหวยออนไลน์จะมีเกมเดิมพันให้เลือกเล่นดังนี้เกมคาสิโนออนไลน์เกมสล็อตออนไลน์กีฬาออนไลน์มินิเกม, เกมหัวก้อย, เกมสูงต่ำ, เกมเป่ายิงฉุบ

- เกมคาสิโนออนไลน์

- เกมสล็อตออนไลน์

- กีฬาออนไลน์

- มินิเกม, เกมหัวก้อย, เกมสูงต่ำ, เกมเป่ายิงฉุบ

ซึ่งเว็บหวยออนไลน์ที่มีเกมเดิมพันให้เลือกเล่นนั้น จะขึ้นอยู่กับเว็บที่ผู้เล่นนั้นเลือก บางเว็บก็อาจจะไม่มีเกมเดิมพันให้เลือกเล่นเลย หรือบางเว็บก็อาจจะมีเพียง มินิเกม ให้เลือกเล่นเท่านั้น แน่นอนว่าการเข้าเล่นเกมเดิมพันนั้น ผู้เล่นไม่จำเป็นต้องทำการโยกเงินไปเล่น สามารถกดเข้าเดิมพันได้เลย โดยเกมส่วนใหญ่จะสามารถเริ่มเดิมพันได้ตั้งแต่ 5 บาทขึ้นไป

คำถามที่พบบ่อย (FAQs)

-

ผู้เล่นใหม่จะเริ่มซื้อหวยออนไลน์ได้อย่างไร?

สำหรับผู้เล่นใหม่ สามารถเริ่มต้นได้ง่ายๆเพียงไม่กี่ขั้นตอนเท่านั้น เริ่มจากเลือกเว็บหวยออนไลน์ สมัครสมาชิก เริ่มฝากเงินเพื่อใช้ซื้อหวย จากนั้นก็สามารถทำการเสี่ยงโชคหวยออนไลน์ได้เลย

-

หากต้องการซื้อหวยออนไลน์เป็นประจำควรเลือกซื้อประเภทไหนดี?

หากเป็นผู้ที่ชื่นชอบการเสี่ยงโชคเป็นประจำทุกวัน แนะนำ หวยฮานอย, หวยลาว, หวยยี่กี หลายออนไลน์เหล่านี้มักจะมีให้เลือกซื้อหลายประเภท และมีการออกรางวัลเป็นประจำ

- หวยออนไลน์ประเภทใดได้รับความนิยมสูง?ผู้เล่นส่วนใหญ่มักจะชื่นชอบในการซื้อหวยรัฐบาล แต่จะออกรางวัลเพียงแค่เดือนละ 2 ครั้งเท่านั้น หวยลาว ถือเป็นหนึ่งในหวยออนไลน์ที่ได้รับความนิยมเป็นอย่างมาก สำหรับนักเสี่ยงโชคชาวไทย เพราะจะมีอัตราจ่ายที่สูง และสามารถเสี่ยงโชคได้เป็นประจำ

- หวยรัฐบาลออนไลน์ต่างจากหวยใต้ดินยังไง?หวยรัฐบาลออนไลน์กับหวยใต้ดิน จะมีรูปแบบการซื้อที่คล้ายกัน จะแตกต่างกันเพียงแค่ หวยรัฐบาลออนไลน์อัตราจ่ายสูงกว่า สามารถซื้อได้ง่ายและสะดวกสบายมากกว่าการซื้อหวยใต้ดิน จึงทำให้หวยรัฐบาลออนไลน์ได้รับความนิยมเป็นอย่างมากในปัจจุบัน