Transforming Invoice Finance with Future-Ready Solutions

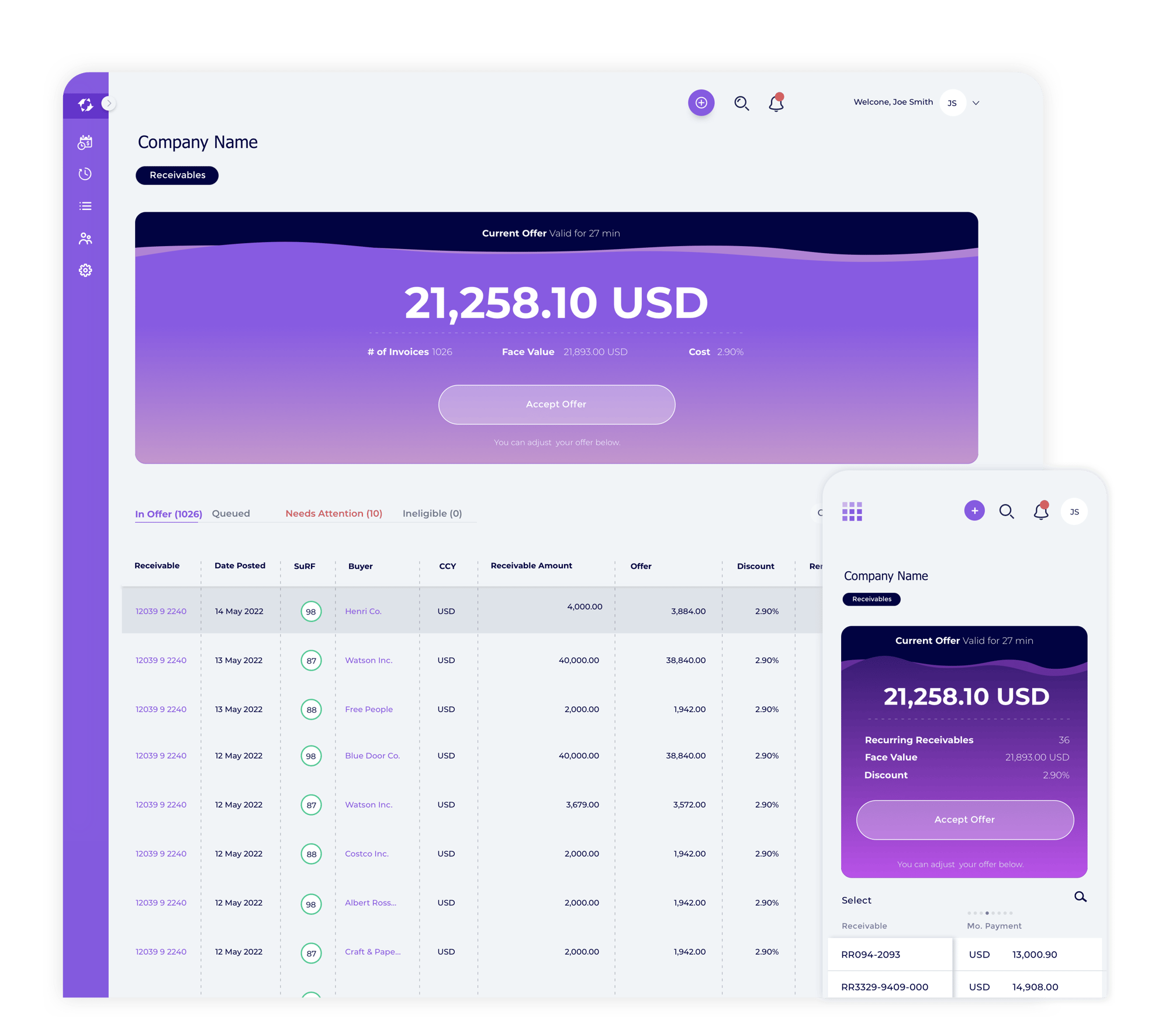

Discover the industry’s most advanced, fully automated invoice-finance platform, instantly customizable to meet the funding style, receivables requirements, and desired return for banks and financial institutions.

$4.68B

Auto Risk Rated

584K

Invoices Analyzed

$90M+

Funded and Growing

25K+

Companies Risk Scored

White-Label Invoice Finance

White-label versions of the Crowdz platform can be customized with your branding, colors, imagery, and messaging while still presenting clients with the core functionality and richness of the overall Crowdz platform.

Leverage our real-time analytics on seller, obligor, and asset data, expertly tailored to meet the complex demands of your bank or financial institution.

Why Crowdz?

Real-Time Risk Score

Streamline Onboarding

Reliable & Secure

Settlement & Automation

How It Works

Hear From Companies We Work With

“The initiative is about the opportunity that we create and ultimately the ripple effect that it has for these entrepreneurs, their families, and their communities”

“While we have been extremely impressed with Crowdz's traction in the traditional invoice receivables financing space, we are particularly excited about the burgeoning asset class of SaaS receivables.”

Crowdz Technology

Modular Platform Design

Array of fully integrated modules customizable for scalability

SURF Score

Proprietary risk scoring to drive optimized yield.

APIs

APIs to automate and accelerate data sharing.