Avalon Marketplace: A Blockchain-Based Receivables Marketplace

Introducing Avalon Marketplace White Paper: A Blockchain-Based Receivables Marketplace. The White Paper explains how the technology behind Avalon Marketplace was built, what problems it is trying to solve, and the roadmap ahead.

1. What is Avalon?

2. Supply Chain Finance Introduction

2.1 Supply Chain Finance (SCF) market overview

2.2 Receivable Factoring Challenges

2.3 Vision

3. What is Crowdz?

4. What is Avalon Marketplace?

4.1 Avalon at a glance

4.2 Ethereum and Polygon

4.3 Stablecoins and fiat considerations

4.4 Benefits

5. Avalon Marketplace - Tokenized Receivables & Tokenomics

5.1 Non-fungible tokens for receivables - NFTr

5.1.1 Onboarding and minting process

5.1.2 Funding and repayment process

5.1.3 Metadata structure

5.2 Avalon Marketplace ecosystem token - Crowdz Token

5.2.1 CRZ token mechanisms

5.2.2 CRZ token issuing and distribution

6. Receivable sourcing, underwriting, and pricing

6.1 Risk-rating & underwriting

6.2 Mitigating risk & SuRF Score

6.3 Pricing

7.1 Insurance

7.2 Recovering unpaid sums

7.3 Liquidation of staked collateral

Avalon Marketplace: A Blockchain-Based Receivables Marketplace

1. What is Avalon?

Avalon is Crowdz’s decentralized marketplace that bridges existing receivables systems with the Decentralized Finance (DeFi) world. Avalon Marketplace aims to tap into the nearly twelve-digit DeFi liquidity channel for the purchase and sale of receivables by introducing operational efficiency, creative system rewards, and smart AI-enhanced scoring for the benefit of SMEs around the world.

Crowdz will tokenize real-world receivables into Non-Fungible Tokens (NFT), offering them for sale at a risk-scored discount on the decentralized Avalon Marketplace. These Non-Fungible Tokens for receivables (NFTr) will represent the terms of individual receivables and ensure the automated flow of funds to the owner of the NFTr using smart contracts.

Avalon Marketplace will also operate a native ecosystem token called Crowdz Token (CRZ) which is designed to promote growth, reward active contributors, allow collateralization of receivables and drive protocol governance.

We believe that by migrating receivables and trades to a blockchain ecosystem, we can modernize an old-fashioned industry and generate the following benefits.

Increase Liquidity

Access new pool of liquidity and investor types

Syndication – Securitization

Fragmentation of receivables and keeping track of ledger is digitized and simplified

Marketing

Defi projects capture attention of industry heavyweights and broader public

Reward

Create the right incentive system for a safer ecosystem

Secondary Trade

Simplify and streamline secondary trade as well as extend reach of Crowdz to other marketplace

Efficiencies

Streamline all processes leading to reduced costs and increased speed of execution

Interoperability

Allow different systems to communicate and operate

CBDC

Prepare Crowd for the future of money

2. Supply Chain Finance Introduction

2.1 Supply Chain Finance (SCF) market overview

Small and medium-sized businesses (SMEs) constitute approximately 90% of all businesses and are responsible for more than 50% of all employment worldwide. SMEs contribute up to 40% of GDP in emerging economies, a percentage that is consistently growing[1].

The global market for receivable factoring in 2021 is estimated to be approximately $3,393 billion, expecting it to expand at a compound annual growth rate (CAGR) of 8.8% from 2022 to 2030[2].

The market is expected to continue growing, as SMEs commonly depend on trade with larger companies, exposing themselves to unfavorable payment terms. Typically, SMEs endure 60-day, 90-day, and even 120+ day terms, and in doing so, experience constrained cash flows that can stunt their growth.

Protraction of receivables payment terms has been exacerbated in recent years due to the COVID-19 pandemic and other global supply chain disruptions. As enterprise groups increase their Days Payable Outstanding (DPO), SMEs are left more vulnerable than ever.

To rectify cash shortages, SMEs typically leverage a working capital solution like supply-chain finance (SCF), a form of Trade Finance (TF) that includes loans, purchase order finance, factoring, and invoice discounting.

Under a factoring arrangement, an SME sells its receivables at a discount to the face value in exchange for immediate cash flow. This transaction transfers the collection obligation over to the receivables Buyer, who will receive a return on their investment upon collecting the full-face value of the receivable. Standard invoice factoring discount rates range from 3-15% with terms of 30-120 days.

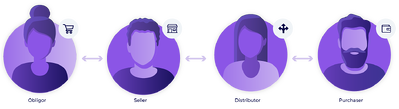

A traditional receivable factoring ecosystem has four main participants:

- Obligor (colloquially the Buyer): The company that buys goods or services from a Seller, resulting in a receivable they are obliged to pay where their obligation to pay is the asset owned by whomever they are obligated to pay;

- Seller: The supplier of goods or services, issuing receivables to the Obligor. They seek working capital by selling the receivable obligation as an asset;

- Distributor: Institutions that perform Seller onboarding, receivable verification, risk assessment, KYC & KYB of Sellers; and

- Purchaser: Institutions and high net-worth individuals who provide working capital by purchasing receivable obligations as assets at a discounted value.

Basic receivable factoring supply chain

The following formula determines the purchase price a Seller receives:

Early payment Discount = Receivable Face Value x (1 – Disc)

Where Disc is the discount rate applied by the Purchaser.

For an example:

- A Seller wants to sell a receivable of $1,000

- The Purchaser decides to buy it at a discount rate of 10%

- The Seller will receive $900 = $1,000 x (1 – 10%)

2.2 Receivable factoring challenges

Presently, legacy technology and processes are hindering the receivables factoring industry. Large financial institutions, such as hedge funds and investment banks, rely on distributors to source the receivables and assess risk. Collectively, the system is centralized, opaque, slow, and error-prone. The lack of a unique format for receivables also makes straight-through processes difficult. Lastly, demand dramatically outstrips the supply available through the current market’s inefficient, costly, and manual reconciliation methods, and so these organizations achieve a high risk-adjusted return between 20-50% APY[3].

Moreover, the current financial downturn coupled with high inflation exacerbates SMEs’ poor access to working capital at fair rates, with capital becoming scarcer and more costly in the 2020s4. Economic crises often trigger a “flight to quality” as lenders and investors seek less-risky investments. This flight frequently comes at the expense of the SMEs who struggle to access working capital because standardized SME risk-rating mechanisms are unestablished.

2.3 Vision

At the time of this writing, banks are paying negligible interest rates on savings. The equities market is in bear territory over fear of recessions and geopolitical conflict, and bonds are trading at unsustainable premiums. By contrast, receivables finance presents an opportunity for investors to earn an annualized risk-adjusted return between 10-20%. We believe that access to such alternative assets is socially and economically important, and through the advent of platform marketplaces, such assets can be made available at rates that are fair to the SME. We also believe that SMEs should get paid sooner without overpaying for access to working capital.

To achieve this vision, we have concluded that a system built on a public Distributed Ledger Technology (DLT) that hosts tokenized assets (digitally registered and tracked receivables) was the way forward. The fundamental traits of blockchain —immutability, transparency, and decentralization — will allow for a reasonable system for all. DLT would increase speed and certainty while lowering risks and cost of capital for SMEs, as well as making receivables purchasing much more widely accessible.

3. What is Crowdz?

Crowdz is a FinTech company that operates a successful business capital platform that offers alternative finance for SMEs through a global exchange for receivables.

Crowdz Marketplace

As it pertains to the marketplace, Crowdz will act as the main distributor, allowing Sellers to upload and subsequently finance their receivables. This process will also see Crowdz assess the creditworthiness of the Seller, Buyer, and Receivable through an AI-enhanced risk scoring mechanism called SuRF Score. Receivables Crowdz determines are worthy of sale will be minted as tokens on the blockchain and added to the marketplace.

4. What is Avalon Marketplace?

4.1 Avalon at a glance

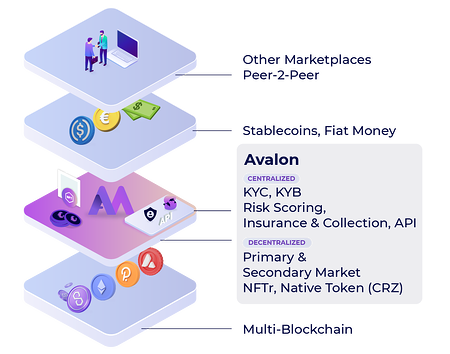

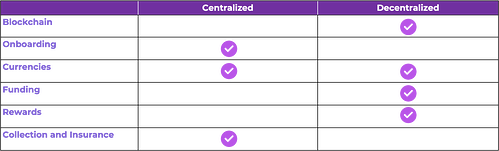

Avalon is Crowdz’s decentralized marketplace that bridges existing receivables systems with the Decentralized Finance (DeFi) world. Avalon Marketplace aims to tap into the nearly twelve-digit DeFi liquidity channel for the purchase and sale of receivables by introducing operational efficiency, creative system rewards, and smart AI-enhanced scoring for the benefit of SMEs around the world.

Built on an Ethereum sidechain, Polygon, Avalon Marketplace allows Sellers or Originators to tokenize their receivables into Non-Fungible Tokens (NFTs) and subsequently offer these assets to Purchasers in exchange for finance in the form of a purchase price for the invoices.

- The marketplace will eventually run on several different blockchains, though the project will initially only utilize an Ethereum sidechain.

- Three technical streams will be at the core of the Crowdz ecosystem:

a. Crowdz will originate, and subsequently mint, receivables as NFTs along with smart contracts that emulate the entire receivable lifecycle;

b. The NFTr (NFT receivable) will be available on primary and secondary marketplaces; and

c. A Native DAO (Decentralized Autonomous Organization) token will be used to govern the platform, and reward active contributors. - Receivables NFTs (or NFTr) will permit receivables to be purchased in a DeFi environment using either fiat money or stablecoins.

- By means of NFTr, receivables can even be traded outside the Avalon Marketplace either on a Peer-to-Peer model (P2P) or into other NFT marketplaces.

In addition to the DeFi stack, Avalon Marketplace offers the following features for sellers/originators and Purchasers:

- KYC/KYB

- Risk assessment and risk scoring (SuRF Score)

- Insurance

- Collections

- APIs

These features of Avalon Marketplace will be provided by Crowdz, whilst the Avalon platform will otherwise operate in a fully decentralized manner. This allows Crowdz to reap the benefits that DeFi brings, such as security, transparency, efficiency, and automation, whilst being an accountable provider of features driven by the needs of regulatory compliance and risk management.

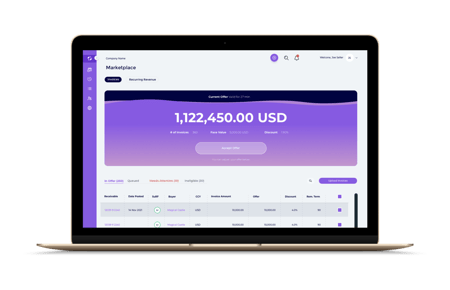

The figure hereafter provides a simple illustration of how Avalon participants interact on the marketplace. For a more detailed view of the process, refer to section Avalon Marketplace – Tokenized Receivables.

-width-450-height-334-name-222-1024x760 (1).png)

For funding to be satisfied, the:

- Seller issues a receivable and uploads it on Crowdz (Crowdz is the Distributor);

- Validity of the receivable is assessed by Crowdz and a SuRF Score is attached to it;

- Receivable described by the invoice details is minted as an NFTr and made available on Avalon Marketplace;

- Receivable is purchased by a Purchaser with either fiat money or stablecoins;

- NFTr, signifying the receivable’s ownership, is transferred from the wallet of the Seller to the wallet of the Funder.

For repayment to be satisfied, the:

- Obligor fulfills the initial obligations and pays the Seller;

- Seller repays the Purchaser either with fiat or with stablecoins;

- NFTr is burnt.

4.2 Ethereum and Polygon

We are choosing to build on the Ethereum sidechain Polygon because the Ethereum mainnet has proven to be the blockchain of choice for financial innovation and active development. At present, Ethereum hosts 3,000+ Decentralized Applications (dApps) and captures most of the value in the ecosystem. As such, we are confident that Ethereum will remain secure, and continue to see innovative applications built on top of it that we can leverage. Polygon enables Crowdz to utilize those strengths, whilst also providing near-instant transaction speeds at a nominal cost, even at times of high demand.

Furthermore, building on a sidechain will provide us with scalability, low transaction costs, fast transactions, and low energy consumption while leveraging Ethereum’s core security features and compatibility with the Ethereum Virtual Machine (EVM).

The impending release of ETH2 Proof-of-Stake (PoS) will address the current challenges faced on Ethereum’s mainnet, making it a safe and sound future-ready choice for Avalon Marketplace.

4.3 Stablecoins and fiat considerations

We believe that cryptocurrencies will become ubiquitous and widely accepted, however, it will be a gradual process, and Sellers are unlikely to accept cryptocurrencies in the short term. Should we want to scale the marketplace and offer the benefits of blockchain, we will have to offer fiat currencies. As a result, Avalon will not force Sellers and Purchasers to transact in stablecoins, but rather provide them with an option to decide which currency they use.

Avalon will provide an on/off-ramp mechanism to ensure that transactions can occur on fiat or stablecoins transparently to the Purchasers or Sellers and to provide an any-to-any marketplace.

Increase Liquidity

Access new pool of liquidity and investor types

Syndication – Securitization

Fragmentation of receivables and keeping track of ledger is digitized and simplified

Marketing

Defi projects capture attention of industry heavyweights and broader public

Reward

Create the right incentive system for a safer ecosystem

Secondary Trade

Simplify and streamline secondary trade as well as extend reach of Crowdz to other marketplace

Efficiencies

Streamline all processes leading to reduced costs and increased speed of execution

Interoperability

Allow different systems to communicate and operate

CBDC

Prepare Crowd for the future of money

5. Avalon Marketplace - Tokenized Receivables & Tokenomics

Avalon Marketplace operates around two key tokens:

– Non-Fungible Token for receivables (NFTr) that represents the terms and ownership of a receivable and ensures the automated flow of funds using smart contracts; and

– A native ecosystem token called Crowdz Token (CRZ) designed to promote growth, reward active contributors, and drive protocol governance.

We describe how each of these tokens works with Avalon in more detail below.

5.1 Non-fungible tokens for receivables - NFTr

NFTs for receivable or NFTr are based on the ERC-721 standard and include a smart contract that encapsulates information pertaining to the receivable factoring lifecycle. For public data, Avalon Marketplace supports the storage of receivable <a href=”#metadata”>metadata</a> in a decentralized file network, <a href=””#ipfs>InterPlanetary File System</a> (IPFS), to reduce storage costs on-chain and to prevent data from being blocked, censored, or changed by a central entity such as a traditional storage solution. Private data is stored in a secure, non-public database, as it isn’t relevant for making investment decisions. It will be stored according to the domestic legal requirements for auditing.

The NFT minting and funding processes are part of a larger onboarding process that Sellers and Purchasers must undertake to interact with Avalon. This is described in greater detail below. In this case the term “minting” should not be taken to mean a new digital asset is created; rather, the technical term “minting” only refers to the creation of an NFT that represents an already existing asset, in this case the receivable.

5.1.1 Onboarding and minting process

Seller Onboarding

Sellers apply to Avalon and undergo strict KYC/KYB procedures, sanctions, PEP (Politically Exposed Persons), and credit checks. They cannot sell receivables until they’ve completed this anti-money-laundering process. Once a seller is on-boarded, Avalon creates and provides a custodial wallet to the seller where the NFTr will be attached.

Approval and Tokenization

Upon being approved, Sellers can upload their unpaid receivables to Avalon. Once submitted, receivables go through an invoice validation tool and are risk-assessed using Crowdz’s proprietary algorithm called the SuRF Score, which is associated with the invoice. Then all data about the receivable is tokenized as an NFTr. The tokenization process writes the invoice to a smart contract that reflects the entire receivable factoring lifecycle. Metadata associated with the receivable will be hosted on the IPFS and Central Database (see Metadata structure). Crowdz doesn’t store sensitive data on-chain for privacy, scalability, and cost (gas fee) reasons.

Purchaser Onboarding

Purchasers will undergo KYC Accredited Investor checks. Upon approval, they can connect and fund their wallet using their existing cryptocurrency holdings or convert fiat into stablecoins through a fiat on/off ramp. Purchasers will also receive the option to personalize and automate their investment experience by selecting a funding limit and risk profile.

5.1.2 Funding and repayment process

Purchase

Receivables will be automatically selected by the auto-bidding engine and priced based on the Purchaser’s expected Annual Percentage Rate (APR). Once a transaction is finalized, the NFTr automatically moves from the Seller’s address to the Purchaser’s address, representing on the ledger the change of ownership of the receivable from Seller to Purchaser.

Note: Future iterations of Avalon will allow Purchasers to re-sell their receivables, by means of NFTr, on a secondary market prior to receiving repayment.

Repayment

Upon receipt of the receivable payment from the Obligor, the final step will see the Seller repay the Purchaser by transferring funds to their wallet via the Avalon platform. Should the Seller receive their payment in fiat but the Purchaser purchased using stablecoins, the Seller will repay in the same fiat currency they received and this sum will then be converted into the stablecoin originally used for payment by the Purchaser using the fiat on/off ramp, allowing the repayment to be made directly into the Purchaser’s wallet.

Exception Handling

While the marketplace takes reasonable steps to limit repayment delinquency through checks and the SuRF score assessment, there will always be cases where receivables are unpaid, paid late, or only partially paid. Avalon will undertake several actions to address these issues (see Exception handling).

5.1.3 Metadata Structure

The diagram hereafter describes the architecture of receivables data. To protect the privacy and commercial confidentiality of the parties to the contract underlying a receivable (the Sellers and the Buyers), its NFTr will only store minimal information on-chain, with most of the metadata being stored on the IPFS network and private databases. Avalon will use private data as part of the onboarding process and for collection and auditing purposes.

Given that information will exist off-chain, Avalon will use Merkle Proofs as a certificate to ensure the authenticity of these data. Purchasers will use the information available to the public to help make investment decisions.

5.2 Avalon Marketplace Token - Crowdz Token

Crowdz Token (CRZ) is the native ERC-20 token on the Avalon platform serving utility for the following:

a) Governance;

b) Reward mechanisms for all parties; and

c) Collateral against outstanding receivables

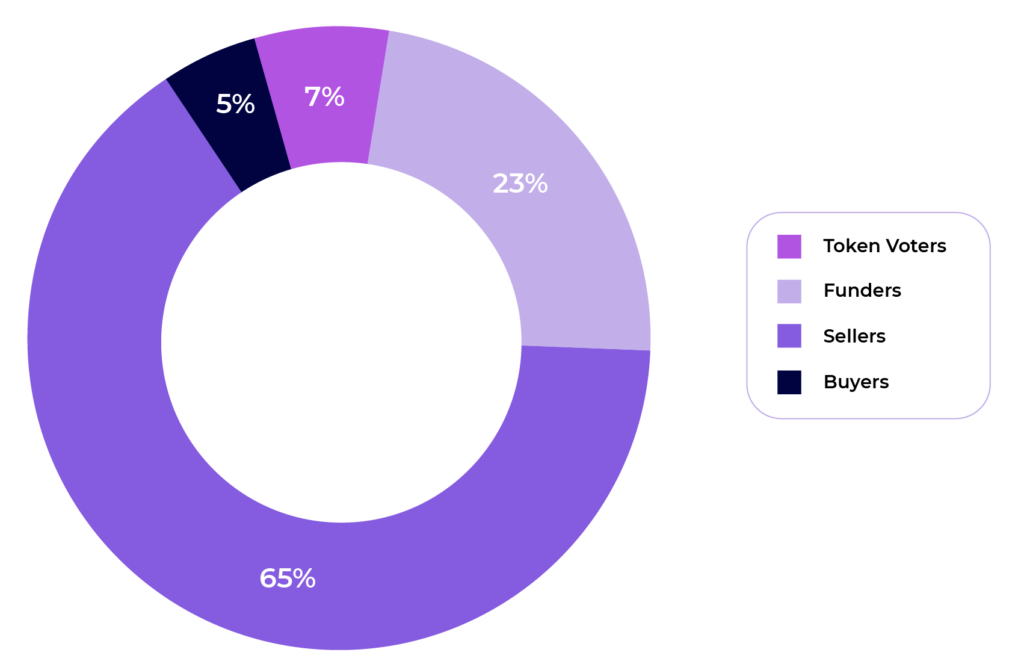

5.2.1 CRZ Token Mechanisms

The CRZ token serves several purposes and operates as follows:

- Funding rewards: CRZ tokens will be distributed from the Community token pool to Purchasers of tokenized receivables, as a reward for being participants in our ecosystem.

- Repayment rewards: CRZ tokens will be given from Community token pool to Sellers as a reward when their receivables are paid on time in full.

- Voting: Entitles the holder to vote on certain Avalon ecosystem governance topics and receive rewards for doing so.

- Oracle participant rewards: Reward other participants such as Buyers to be active in the ecosystem by offering them CRZ tokens.

- Collateralization of receivables: Sellers will be able to use CRZ tokens as collateral against the risks of receivables they sell as NFTr, and in doing so, will improve the risk rating of their assets, and reduce the discount cost at sale.

To expand further on each of these points:

a. Funding Rewards

Purchasers of receivables using NFTr will be rewarded with CRZ tokens by supplying liquidity to the ecosystem, and for every NFTr receivable they purchase, a share of CRZ tokens will be issued to their wallet as a reward. The share of tokens they receive will be based on a weighted monthly average of the value of the receivables, represented by NFTr, bought in each month.

- Rewards are capped to 1% of the amount funded, as based on the CRZ market price determined at the time; and

- Any surplus of CRZ tokens over the 1% threshold will be used to replenish the community reserve pool.

The following formula will determine purchaser rewards:

CRZ=min((Amount invested)/(Σ(Receivables funded))× #Community(Purchaser),1% × Amount invested)

| Variables | Descriptions |

| CRZ | The native token of Avalon Marketplace |

| Amount Funded | The total amount a Purchaser has funded during the month |

| Receivables Funded | The total amount of all receivables funded during the month |

| #Community (Purchaser) | The total amount of CRZ tokens to be released to Purchasers during a month |

Use case

For a specific month:

- 1M tokens are reserved for rewarding Purchasers at a value of $0.02. The total value of tokens released is $20k.

- 2 Purchasers fund receivables for the respective sums of $30k and $470k, for a total funding of $500k.

They should receive the following rewards:- Purchaser 1: CRZ = min($30k/$500k×$20k,1% × $30k) =$300

- Purchaser 2: CRZ = min($470k/$500m×$20k,1% × $470k) = $4.7k

- In this example both Purchasers had their rewards capped to 1% and the surplus sent back to the reward pool.

- These rewards are paid in addition to the margin they earn from purchasing the receivable, via NFTr, at a discount to the total receivable due.

b. Repayment Rewards

For each NFTr that is sold and fully repaid on time, a portion of CRZ tokens will be issued to the Seller in accordance with the same distribution formula that applies to Purchasers.

These rewards will also be capped to 2% of the amount repaid. Any surplus tokens over the 2% threshold will be re-provisioned to the community reserve pool.

The funding reward observes the following formula:

CRZ=((Amount repaid)/(Σ(Receivables repaid))× #Community(Seller),2% × Amount repaid)

| Variables | Descriptions Color |

| CRZ | The native token of Avalon |

| Amount repaid | The total amount a Seller has repaid during the month |

| Receivables repaid | The total amount of all receivables repaid during the month |

| #Community (Seller) | The total amount of CRZ tokens to be released to Sellers during the month |

Use case

For a specific month:

- 6.5M tokens are reserved for rewarding Sellers at a value of $0.01 for a total value of $65k.

- 4 Sellers repay several receivables for the respective sums of $50k, $200k, $250k, and $500k for a total of $1m.

- Seller 1: CRZ = min($50k/$1m×$65k,2% × $50k) =$1k

- Seller 2: CRZ = min($200k/$1m×$65k,2% × $200k) = $4k

- Seller 3: CRZ = min($250k/$1m×$65k,2% × $250k) = $5k

- Seller 4: CRZ = min($500k/$1m×$65k,2% × $500k) = $10k

- In this example Purchasers had their rewards capped to 2% and the surplus sent back to the reward pool.

c. Voting

Holders of CRZ tokens will be entitled to vote on important changes or additions to the Avalon Marketplace ecosystem, such as adding a new receivable source or underwriter. For a proposal to be accepted, 51% of tokens voting must vote in favor, and 4% of all tokens in circulation need to be cast. For being active participants, voters will be rewarded with CRZ from the Community token pool.

d. Buyer Rewards

We strive to create a virtuous ecosystem where the Buyer of goods can become an on-chain Oracle by providing information such as Proof of Delivery, which would create a more robust marketplace and increase the predictability of the supply chain. Buyers who choose to participate will be rewarded with CRZ, noting that the rewards will follow the same logic as the Seller and Purchaser rewards, i.e. Buyers receive a share of the community token issued monthly based on the level of involvement on Avalon.

We plan to reserve 7% of the community token for Buyers. However, implementing this entails a higher level of complexity, and so would be launched in subsequent versions of Avalon once fully assessed:

CRZ=(Nb of inputs)/ΣInputs× #Community(Buyer)

| Variables | Descriptions |

| CRZ | Avalon tokens to be received |

| Nb of inputs | The total number of information provided as an Oracle on chain |

| #Community (Buyer) | The total Avalon Community token to be released for this month for the Buyer |

e. Collateralization of Receivables and Liquidation

Sellers will be able to pledge their CRZ tokens as collateral for the asset value risk, against the Obligor’s payment obligation and likelihood to dilute the asset value, when applying to sell receivables. This value will be considered when Avalon determines the receivables’s SuRF score and discount rate. When tokens are pledged as collateral, they are custodied, a process that is powered by our smart contract, where they will remain until the Purchaser is repaid. If a Seller fails to repay a Purchaser in whole or part, a formal recovery process commences (see Recovering Unpaid Sums). The term collateral is typically used in the context of a loan: a Seller’s asset or amount strictly encumbered to offset one metric—the risk that a borrower will not repay. The term is here used for ease of explanation, but is technically value in CRZ offered by the Seller in exchange for a better discount rate in a fiat currency, provided certain conditions are met. We anticipate this will be a more efficient exchange of CRZ for fiat currency. Whether the sale goes depends on a network of risk attributes of the Obligor, Seller performance, dilution risk, and other attributes of the receivable.

A liquidation threshold is also in place to mitigate the risk of CRZ market fluctuations and ensure the collateral value is properly covered. This happens when the collateral decreases in value.

Avalon will use the following parameters when determining the CRZ Seller discount:

- Price to Value (PTV): 50%

- Liquidation threshold (max Price to Value): 70%

| Variables | Descriptions |

| PTV | The Price to Value (PTV) is expressed in percentage and defines the amount of purchase price discount (in currency) that can be reduced with collateral. In this case, every two CRZ tokens provided as collateral will reduce the discount rate by $1 |

| Liquidation threshold | The liquidation threshold is represented as a percentage of a max PTV (Price to Value), beyond this value the position is considered as under-collateralized. |

The delta between the PTV and the Liquidation Threshold is a safety cushion. In case the PTV goes beyond the 50% threshold, Avalon will send a margin call to invite the seller to further collateralize the asset risk with a top-up of CRZ tokens.

We provided hereafter a possible scenario with CRZ tokens used as collateral compared to a scenario with no collateral.

Use cases

Parameters:

- The Seller uploads an invoice of $100k

- Avalon applies a 6% discount to the receivable

- The minimum discount Avalon applies, regardless of how much collateral, is 2%

- Collateralization ratio is 50%

- Liquidation threshold is 70%

Use case 1 – No collateral provided

A Seller lists a receivable for sale via NFTr at a price of $100k, and a Purchaser purchases this with a discount rate of 6%. Assuming the Seller doesn’t post any collateral, they would receive $94k and are obligated to pay back $100k.

Use case 2 – Collateral provided

A Seller lists a receivable NFT for sale via NFTr for sale at a price of $100k, along with 5k CRZ tokens which are transferred to a smart contract as collateral.

Assuming the current market rate of CRZ tokens is 1 CRZ = $3, the collateral provided equals 5k CRZ x 3 = $15,000.00.

Under this scenario, upon a purchaser buying the a receivable for sale via NFTr, the Seller would receive:

$1k x min(100×(1-2%),94+15×50%)=$1k x min(98,101.5)= $98k

Note: At this point, the Seller only needs to have deposited the following amount:

$4k ÷50% ÷3 = 2.66k CRZ

The Seller would therefore be able to freely withdraw up to 5 – 2.66 = 2.34k worth of CRZ tokens. Alternatively, they can leave the collateral position as is, making the discount margin over-collateralized.

Use case 3 – Token appreciation scenario

Assuming in the above scenario that the token value of CRZ appreciates to 1 CRZ = $4.

The Seller withdraws 2k worth of CRZ tokens, leaving collateral of 3k CRZ.

Given the value appreciation of CRZ, the withdrawal doesn’t impact the collateralization ratio, with the amount still sitting below the collateralization ratio of 50%:

PTV=$4k/(3k x $4)=33%<50%

Use case 4 – Token depreciation scenario

Assuming in the above scenario that the value of CRZ depreciates to 1 CRZ = $2.

Given the depreciation, the collateral is now valued at $6k (3k CRZ x $2 = $6k). As such, the Seller cannot withdraw any collateral as the market value of the position is above the collateralization ratio of 50%:

PTV=$4k/(3k x $2)=66%<70%

Liquidation is not triggered, as PTV is still below the liquidation threshold of 70%. Rather, a margin call is sent to the Seller, warning them to either top up their collateral.

Use case 5 – Token depreciation and liquidation scenario

Assuming in the above scenario that the value of CRZ token depreciates further to 1 CRZ = $1.2. The drop in value reduces the collateral position to $3.6k (3k CRZ x $1.2 = $3.6k), which triggers a liquidation event as PTV is above the liquidation threshold of 70%:

PTV=$4k/(3k x $1.2)=111%>70%

When liquidation is triggered, the smart contract holding the collateral automatically sends the collateral to the Purchaser address. Under this scenario, the Seller loses their collateral but is still obliged to repay the full $100k.

5.2.2 CRZ token issuing and distribution

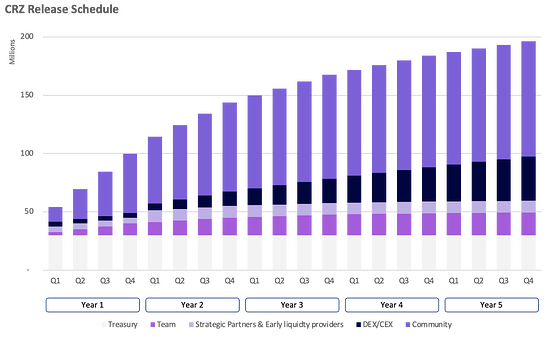

A maximum of [200,000,000] CRZ tokens will be minted at genesis. Tokens will be released at a declining rate over time to enable the tokens to establish a market value without inflationary pressures. Also, to demonstrate sustained incentive alignment for token beneficiaries at genesis (team, investors, advisors), their tokens received will be vested over three years.

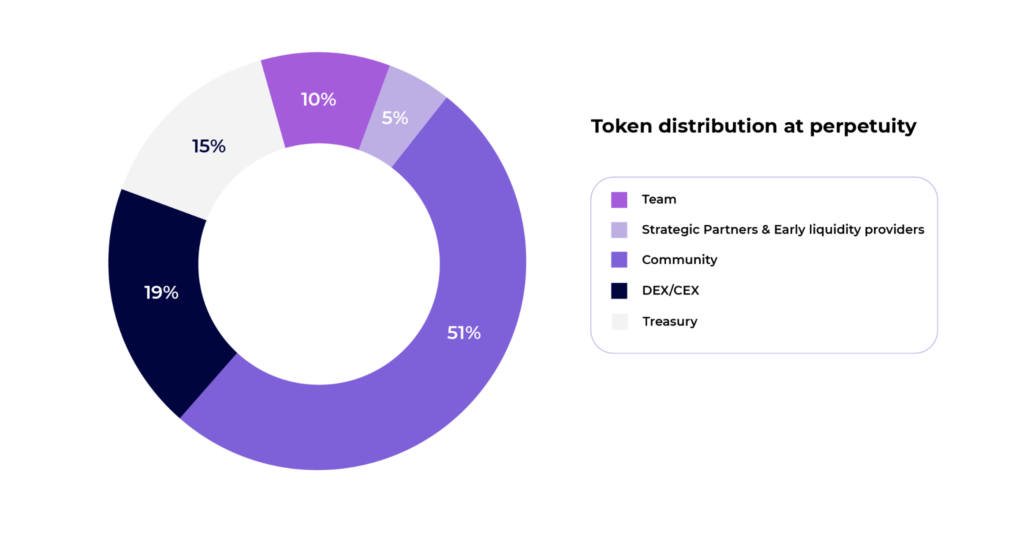

The diagrams hereafter display the token distribution at perpetuity and the release schedule over the next five years.

Token distribution at perpetuity

Team

The Crowdz team will receive tokens as an incentive tool and will be serving a three years vesting period.

Strategic Partnership & Early Liquidity Providers

Key partners and liquidity providers will receive CRZ tokens. CRZ token reserve will vest these tokens over a period of two years.

Crowdz early investors (Pre-seed, Series A, and Series B) and advisors who have contributed to the project in its early days, will vest over three years.

DEX / CEX

Following genesis, 3% of CRZ tokens will be issued to DEX exchanges to enable price discovery. The right bonding curve will be assessed, as a 50/50 automated market maker (AMM) pool would require a significant amount of liquidity. Avalon will take an average of market prices from a set selection of exchanges to determine the price applied to CRZ tokens to calculate the number to which ecosystem participants are entitled from time to time.

Crowdz also expects to provide further CRZ tokens to be released on key central exchanges (CEX).

Community

The community will be the prime beneficiary of the CRZ token. It will be used as a liquidity incentive to drive beneficial engagement with the platform, i.e., voting, paying on time, providing information, and providing liquidity.

The reserve vesting period for tokens in circulation follows an infinite geometric series: Tokens in circulation (n) = Tokens ∑_1^n 1/2^n where n is the number of years.

Treasury

Avalon is planning to keep [30] million tokens in its treasury for future projects such as (but not limited to):

Investment cost: Funding new projects

Development expense: Adjusting strategy if necessary

Operational overhead: such as buying banking and asset management licenses

CRZ Community tokens will be rewarded and distributed to participants on a monthly cycle as follows:

Community token reward

The CRZ tokens are released on a monthly cycle and the schedule is determined as follows:

Release of the token over time

Future changes on smart contract

As Avalon will require several upgrades over time to the smart contracts and reward model, the Avalon core team reserves the right to update the smart contracts using proxy contracts to address challenges or better reflect the needs of Avalon. Several parameters will be coded as changeable variables to avoid contract re-deployment.

6. Receivable sourcing, underwriting, and pricing

6.1 Risk rating & underwriting

As with any finance arrangement that involves a repayment obligation, it is important to assess the risk of non-payment. With respect to receivables finance, it’s also essential to consider the additional risk of fraud. We have identified the following risks in receivables finance, though there may be others.

Risk of delinquent payment

A risk that neither the Obligor nor the Seller repays the principal in full, or on time.

Risk of receivables fraud

A potential risk in receivables finance is fraud. Fraud in the receivables finance sector is low; however, it’s a risk that Avalon will proactively address to minimize risk and maintain a healthy marketplace.

Typical fraud in the receivables finance sector takes place in a variety of ways, namely:

i. Fictitious Receivables: A fraudulent Seller posts fictitious receivables with the intention of receiving funding and leaving the platform without repaying the Purchaser. There is no real buyer or assignment of goods in this scenario, and such situations are typical of money laundering activities.

ii. Duplicate Receivables: A fraudulent Seller posts duplicate receivables. Under such an arrangement, the Seller will likely use several platforms to balance finance across multiple purchasers and/or lenders For instance, fraudulent Seller might borrow financing that places a lien on a receivable, and then also sell that receivable on another platform as though it were free of any lien or other encumbrance.

iii. Over-Invoicing: A fraudulent Seller overcharges a Buyer and posts these purposely inaccurate receivables. Using credit notes, the Seller will display different information to the Buyer to successfully receive the extra finance.

iv. Collusion: A fraudulent Seller colludes with their Buyer to raise fictitious or overcharged receivables.

v. Settlement Diversion: At the time of settlement, a fraudulent Seller diverts payments made by their Buyer to an alternative account, i.e. a different account to that which was provided to the platform.

vi. Contract Set-Off Arrangements: A fraudulent Seller doesn’t disclose existing contractual set-off arrangements, which may undermine the recoverability of the financed receivables. When this happens, a receivable Seller typically hopes that these set-off requirements reduce to nothing over the term they’ve financed their receivables.

vii. Disputes: The fraudulent Seller fails to disclose ongoing disputes with their Buyer in relation to the receivables they have posted.

viii. Re-using Aged Receivables: The fraudulent Seller re-uses aged/problematic receivables and posts these to Avalon under the guise they are new.

Of the types of fraudulent acts performed by Sellers listed above, there’s a common element to nearly all of them: The opportunity to defraud a financier typically stems from the trust financiers place in Sellers. Under the scenarios listed above, a Seller has devised a plan that allows them to exploit loopholes in the financing arrangement and/or the lack of connectivity between their financier and Buyer.

Avalon continues to ensure the appropriate systems are in place to catch fraud early. This will include rigorous vetting of Crowdz’ origination, underwriting processes, and methodology pertaining to data collection, analysis, and scoring.

6.2 Mitigating risk & SuRF Score

Avalon uses several methods to mitigate risk as it pertains to fraud and non-repayment.

KYC and KYB

Through Crowdz, all Avalon participants will undergo strict KYC and KYB processes before they are approved to use the platform. With respect to Sellers, their information will be cross-checked against data providers like Equifax, Experian, or Dun & Bradstreet, ensuring they are clear of default. Crowdz will also prompt Sellers to connect their accounting software and bank accounts to their software, so historical information can be used in the risk-scoring process.

Purchasers will also undergo KYC/KYB processes before they can transact on the platform.

SuRF Score

Crowdz has developed and extensively tested its SuRF Score (Sustainability, Risk, & Financial Score). The score predicts the likelihood a company will pay its obligations on time or before the obligation becomes delinquent. A companion metric called the DBT Score (Days Beyond Term) also contributes to the SuRF Score. The DBT score predicts how late (how many days beyond term) the Seller may be paying its obligations.

Several factors are used to determine the SuRF Score:

- An assessment of the company’s external credit ratings;

- Basic and advanced analysis of its financial metrics;

- Their historical likelihood and timeliness of paying their external debts (debts not related to Crowdz or Avalon); and

- Their historical record of repaying receivables financing within the Crowdz and Avalon ecosystem.

The respective role and contribution of these factors is refined over time using AI based on their historical predictive accuracy. Ultimately, separate scoring protocols will be established depending on a company’s industry, geography, size, and structure.

Accounting Software and Banking

Crowdz connects to most accounting software and, when possible, banking platforms using open banking or screen scraping. These allow the collection of critical information that helps to de-risk transactions.

6.3 Pricing

The pricing (discount rate) a Seller receives on their receivables will be determined by the Automated Crowdz Discount Rate Assignment Model. This stems from the Seller’s SuRF score and other factors to dynamically calculate and assign, in real-time, a risk-rated discount rate.

The calculated discount rate accounts for various financially-relevant possibilities, such as non-payment and late payment. The discount rate can also be parameterized on a company, industry, geographical, or individual receivable basis. Lastly, other variables are considered, including insurance costs, UCC filings and fraud prevention costs, maximum APR to the receivable Seller, and the return to the receivable purchaser and Crowdz.

These complex calculations result in a score for each receivable and the company selling them, creating a risk grade and corresponding discount rate; the lower the risk, the lesser the discount, and vice versa.

In addition, a Seller can reduce the discount rate applied by staking CRZ tokens and using them as collateral against the receivable posted, as described in the Token Mechanisms section above. By engaging in this activity, a Seller can positively impact their discount rate.

7. Exception Handling

7.1 Insurance

Purchasers can protect their capital by taking out insurance when they buy receivables. The insurance premium varies based on the risk associated with the Seller and the amount of capital they’ve outlaid.

Note: Insurance payouts are only triggered after the formal collections process is finalized. At this stage funds have been recovered, or funds have not been recovered (or partially recovered). If it’s the latter, the funds will be recorded as a write-off, and the insurance company will commence its process to settle the payout directly into the purchaser’s wallet.

7.2 Recovering unpaid sums

When a receivable is not paid in full or when payment is late, Avalon will undertake the following actions:

a) The Seller is reminded of the outstanding payment via our first party collection partner who will send several reminders (emails, phone calls)

b) If full repayment still hasn’t occurred, Avalon will commence a formal collections process with a debt collection agency, typically to collect from the Obligor.

| Days past due | Actions |

| 30 | Liquidation of 10% of the collateral to signal that the Seller needs to act. The smart contract will execute this on the 30th day. |

| 60 | Liquidation of the collateral to an amount that recovers the price advantage (the discount reduction on the face value of the receivable) the Seller received. The smart contract will execute this on the 60th day after their receivable was due to be paid. This time buffer is permitted to not punish short-term delays beyond the Seller’s control (such as Buyer non-payment). |

| 90 (expected write-off) | Liquidation of all remaining collateral. |

CRZ tokens will automatically be sent to the wallet of the respective Purchaser and the value upon transfer will be deducted from the overall sum outstanding on the contract.

As further sums are recovered from the Seller, they will be paid to the wallet of the respective Purchaser per the usual distribution metrics.

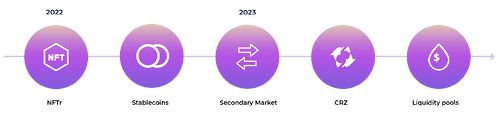

8. Roadmap

This whitepaper describes v1.0 of Avalon; however, as the world continues to embrace the tokenization of assets and the use of distributed financial systems, we envisage an environment that’s conducive to further iterations of Avalon.

The first iteration of Avalon will be released in 2022, commencing our feature roadmap as follows.

NFTr

Stage 1 of Avalon is to deliver an NFTr Marketplace that allows Sellers and Purchasers to conduct business through the buying and selling of receivables tokenized according to the NFTr standard, utilizing fiat currencies.

Stablecoin

Ability for Purchasers to use a USD stablecoin to purchase a receivable by NFTr. Further opportunities to do on-/off-ramp transactions

Secondary market

Allow receivables, via NFTr, to be sold on a secondary market before the receivable payment date.

CRZ Token

Based on the ERC-20 token standard, CRZ is the native token of Avalon that will be minted and used to drive the decentralized marketplace described in this whitepaper.

Liquidity pools

Future versions of Avalon will, subject to prior regulatory authorization, offer Purchasers Liquidity Pools collateralized by receivable NFTr. Presently, DeFi liquidity pools are crowdsourced pools of crypto tokens locked in a smart contract to facilitate trading between asset pairs on a decentralized exchange. These pools are operated by Automated Market Makers (AMMs), which facilitate peer-to-peer trading in an automated and permissionless manner. By collateralizing Liquidity Pools with receivable NFTs, Avalon aims to bring the industry a different type of investment opportunity, one backed by Real World Assets.

Avalon also aims to facilitate more complex transactions such as syndication for large receivables.

9. Glossary of Ecosystem

DeFi

Powered by smart contracts, the Ethereum blockchain has given rise to a new financial vertical known as decentralized finance (DeFi). This new vertical is booming, with 3,000+ decentralized applications (dApps) offering disruptive solutions for lending and deposits, stablecoins, derivatives, and more. While other blockchains also offer DeFi products, Ethereum boasts 100 billion in total value locked (TVL), a metric used to measure the amount of liquidity locked in decentralized protocols, making it the biggest and most used blockchain for these financial products.

Ethereum 2.0

Ethereum 2.0 offers several upgrades to its mainnet, seeking to address current shortcomings around scalability. Expecting to go live sometime in 2022/23, the upgrade will make the Ethereum blockchain more secure and scalable (supporting thousands of transactions per second). To achieve these objectives, Ethereum will use blockchain sharding and move from a Proof-of-Work (PoW) consensus algorithm to Proof-of-Stake (PoS), allowing validators to propose and validate blocks without using the energy currently required to mine these blocks under a PoW algorithm.

IPFS

IPFS is a peer-to-peer hypermedia protocol that is upgradeable, resilient, and more open than traditional databases. It efficiently distributes high volumes of data without duplication and powers the creation of diversely resilient networks that enable persistent availability. IPFS enables an efficient transition to a decentralized version of the web for developers and users. It has been the standard for respected platforms to store non-fungible tokens metadata.

Non-Fungible Token

Unlike fungible tokens (ERC-20), a non-fungible token (ERC-721), is a unique and non-interchangeable unit of data stored on a blockchain. Lately, NFTs have been heavily associated with digital art or game artifacts, which use NFTs as a certificate of ownership. However, with respect to Avalon, Real-World Receivables are tokenized as NFTs and provide a representation of these assets on the blockchain.

Receivable

A receivable, owned as an asset, is the right to receive the money owed by a Buyer in exchange for products or services sold to that Buyer by a Seller. The payment terms and information about the goods and services the Seller business provided to its Buyer customer are captured in a Seller-issued invoice. It is a basic premise of the model expressed in this paper that a receivable may be treated as an asset, and either encumbered or freely sold as such. With respect to this asset, the Buyer is the Obligor, and upon its sale by the Seller in exchange for funds, the funder is the Purchaser. Upon this sale the Obligor owes money to the Purchaser.

Stablecoins

Stablecoins are a class of cryptocurrencies that draw their stability from being pegged to physical or digital assets, like fiat, or cryptocurrencies, and sometimes, through algorithms that regulate supply and demand to achieve price stability. Typically based on the ERC-20 token standard, stablecoins have proved to be a powerful tool in the cryptocurrency ecosystem. They provide instant on-chain settlement, do not fluctuate in value, and can be adapted to incorporate privacy features. Central Banks across the world are piloting their own versions of stablecoins, known as ‘central bank digital currencies’ or CBDC, noting that these assets would exist on permissioned blockchains and be guaranteed by the government where the central bank operates.

Presently, the three main Stablecoins are DAI, USDC, and USDT, with USDC being collateralized by USD Fiat at a 1:1 ratio. While DAI also has a substantial portion of its collateral being made up of USD Fiat, the decentralized stablecoin also includes other cryptocurrencies in its collateral pool, such as Ether.

10. Glossary of Terms

Avalon Marketplace: Avalon is the decentralized marketplace of Crowdz on the blockchain. It encompasses the entire marketplace infrastructure as well as supporting features such as on-boarding, risk scoring, collection or insurance

Altcoin: Altcoin is any cryptocurrency than Bitcoin, e.g. Ether

Bitcoin: Bitcoin is the first cryptocurrency that came into existence in 2009 by Satoshi Nakamoto

CeFi: CeFi stands for Centralized Finance as opposed to DeFi for Decentralized Finance

Crowdz Token (or CRZ): CRZ is a DAO token that is here to incentivize the right behavior on Avalon Marketplace

CBDC: CBDC stands for Central Bank Digital Currency (CBDC), is the virtual form of a fiat currency issued by Central Banks

CEX: Refers to Centralized Exchange, e.g. Coinbase

dApp: dApp stands for decentralized applications that run without control of a central authority

DAO: DAO stands for the decentralized autonomous organization. Usually based on ERC-20 standard

DBT: Days Beyond Term

DeFi: DeFi stands for Decentralized Finance, is an umbrella term for financial services on public blockchains, primarily Ethereum

DEX: Refers to Decentralized Exchange, a peer-to-peer marketplace, e.g. Aave or Compound

DLT: DLT stands for Distributed Ledger Technology (DLT) meaning that a ledger is distributed in multiple places

Ethereum: Ethereum is a decentralized blockchain with smart contract functionality

Ether: Ether is the fuel that powers distributed Ethereum blockchain

ERC-20: ERC-20 is a technical standard for issuing fungible tokens on Ethereum blockchain

ERC-721: ERC-721 is a technical standard for issuing non-fungible tokens on Ethereum blockchain

Fiat: Fiat is the government-controlled currency and is declared as legal tender

ICO: ICO stands for Initial Coin Offering that is issued by startups to raise funds by selling tokens

KYB: Know Your Business is the process to assess and understand one’s business

KYC: Know Your Customer is the process to assess and understand one’s individual

Mainnet: Mainnet is a working blockchain product that also provides the ability to transfer digital currencies or assets between users in a blockchain environment

Margin call: A margin call is an indicator that the value of a security or asset held has decreased in value below a defined threshold. Margin calls require additional capital to bring an account up to the minimum maintenance margin

NFT (or ERC721): NFT stands for Non-Fungible token, which is a non-interchangeable unit of data stored on a blockchain, a form of digital ledger, that can be logged or moved on the blockchain to symbolize the ownership and sale or trade of the asset it represents

NFTr: a subtype of NFT, used as a digital representation of an asset (a receivable) on the blockchain as a Non-Fungible token. The NFTr is the token that represents the receivable being traded on the platform

PTV: Loan To Value is a financial term used by lenders to express the ratio of a loan to the value of an asset purchased. In this case there is no loan, but the calculation is the same, to permit tokens to be reserved in exchange for purchase price discount reductions. Thus the term: Price To Value

SCF: Supply chain finance where suppliers can receive early payment by selling their receivables

Stablecoins: A stablecoin is a class of cryptocurrencies that attempt to offer price stability and are backed by a reserve asset

References

[1] Small and Medium Enterprises (SMEs) Finance – The World Bank

[2] Factoring Services Market – Grandview Research

[3] Typical Factoring Rates – Commercial Capital LLC

[4] Why capital will become scarcer in the 2020s – The Economist